The global financial system is on the verge of transformation. With more than 130 countries exploring Central Bank Digital Currencies (CBDCs), digital cash issued by governments is no longer a distant concept—it’s rapidly becoming reality.

As CBDCs roll out, traders are asking a critical question: where are the arbitrage opportunities?

Artificial intelligence (AI) and algorithmic trading systems are uniquely positioned to exploit the inefficiencies of this new asset class, whether across borders, between CBDCs and stablecoins, or in hybrid fiat–crypto ecosystems.

This article explores how AI-driven arbitrage can capture spreads in the evolving world of CBDCs.

💹 What Are CBDCs?

A Central Bank Digital Currency (CBDC) is a digital form of a country’s fiat currency, issued directly by its central bank. Unlike decentralized cryptocurrencies, CBDCs are:

- State-backed: carrying the same legal status as traditional money.

- Programmable: capable of enforcing smart contracts and usage restrictions.

- Traceable: designed for transparency and compliance.

Examples include China’s Digital Yuan (e-CNY), the Bahamas’ Sand Dollar, and pilot projects in the EU, UK, and U.S.

🔁 Why CBDCs Create Arbitrage Potential

Whenever a new asset class enters the market, inefficiencies emerge. For CBDCs, the key arbitrage drivers are:

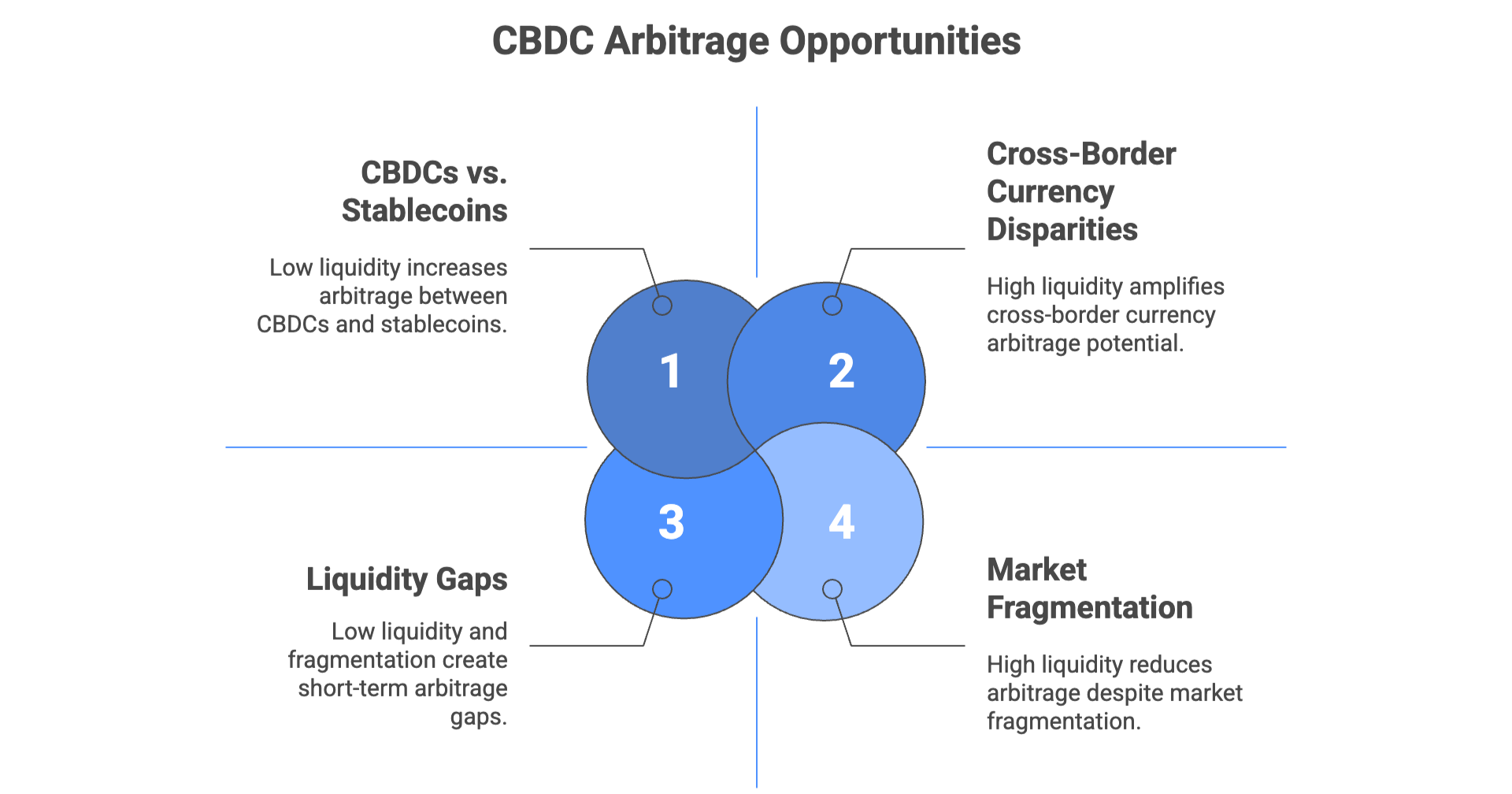

Cross-Border Currency Disparities

- Early CBDCs may have limited convertibility.

- AI can detect pricing discrepancies between CBDCs and their fiat equivalents across borders.

CBDCs vs. Stablecoins

- Stablecoins (USDT, USDC, DAI) dominate digital liquidity today.

- Arbitrage opportunities will arise when CBDCs trade at premiums or discounts relative to stablecoins on global exchanges.

Market Fragmentation

- With different rollouts, settlement times, and restrictions, spreads may exist between two CBDCs (e.g., Digital Euro vs. e-CNY).

Liquidity Gaps

- CBDCs will initially have thin order books compared to crypto markets.

- AI can capture short-term inefficiencies as liquidity builds.

🤖 The Role of AI in CBDC Arbitrage

AI algorithms are uniquely suited for CBDC markets because they can:

- Analyze multi-market data in real time: across CBDCs, stablecoins, and fiat FX markets.

- Execute cross-border strategies: spotting spreads too fast for manual traders.

- Adapt to regulation & restrictions: optimizing for settlement windows, transaction limits, or jurisdictional rules.

For example, an AI system could monitor Digital Yuan (e-CNY) vs. USDC across multiple exchanges. If liquidity constraints cause e-CNY to temporarily trade at a 0.5% premium, an arbitrage bot can immediately exploit the spread before it normalizes.

🦾 Challenges in CBDC Arbitrage

Despite the potential, there are hurdles:

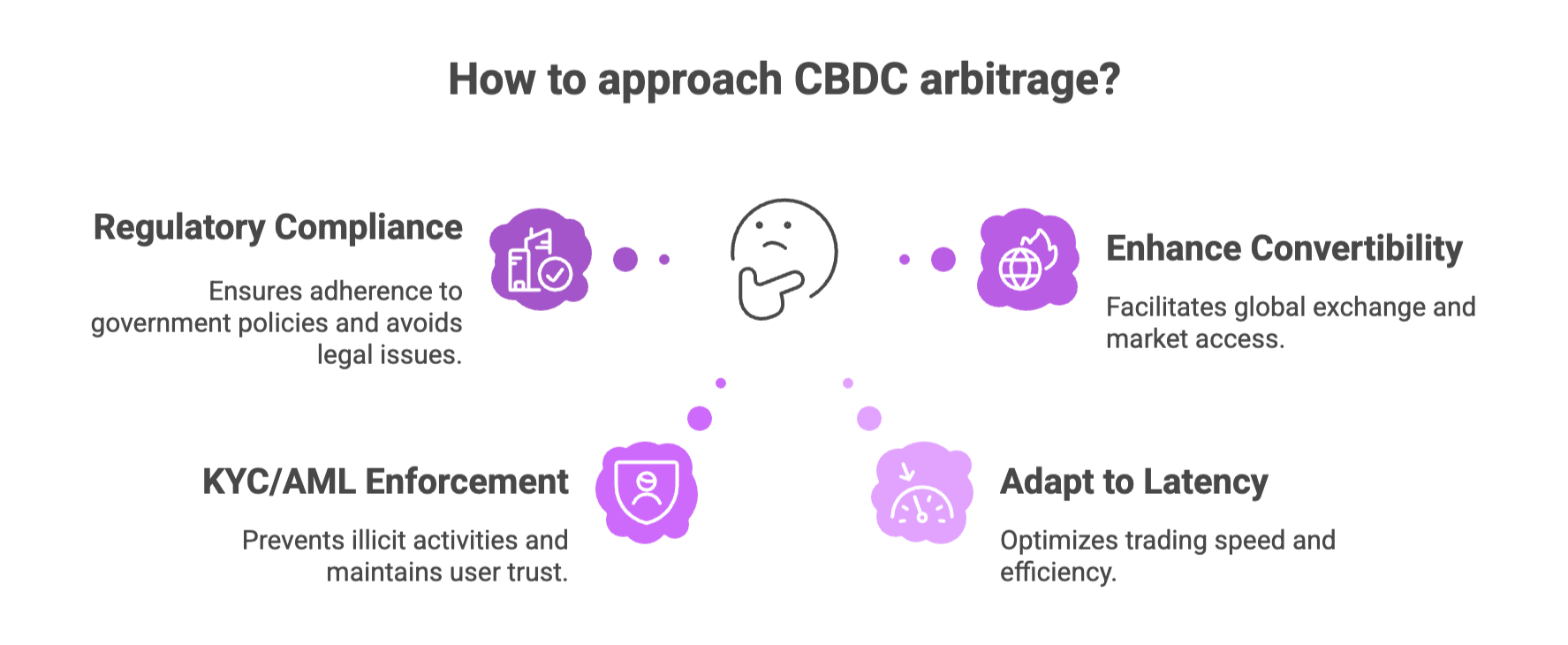

- Regulatory Uncertainty: Governments may restrict arbitrage between CBDCs and crypto to maintain monetary control.

- KYC/AML Enforcement: CBDCs are programmable; wallets may be restricted by user identity or geography.

- Latency Risks: AI bots must adapt to new settlement protocols, which may differ from traditional FX or crypto.

- Limited Convertibility: Some CBDCs may not be easily exchangeable outside their domestic markets.

These challenges mean that CBDC arbitrage is not just about speed—it’s about compliance-aware intelligence.

🎓 Case Study: Potential Arbitrage Scenarios

- e-CNY vs. USDT

- If Chinese residents are restricted from converting e-CNY directly into USDT, offshore traders might price e-CNY higher or lower than its fiat peg.

- AI can capture these offshore/onshore spreads.

- Digital Euro vs. Euro (EUR)

- Early CBDC pilots may trade at slight premiums to traditional EUR due to settlement speed advantages.

- Arbitrage opportunities could appear in cross-exchange trading.

- CBDC-to-CBDC Spreads

- If the Digital Pound and Digital Euro launch with different exchangeability rules, spreads may exist between them on global payment rails.

- e-CNY vs. USDT

🪬 The Future of CBDC Arbitrage

The rollout of CBDCs won’t eliminate arbitrage—it will multiply it in unexpected ways. We may see:

- CBDC–Stablecoin Pairs becoming core arbitrage routes.

- AI-powered cross-border liquidity pools that instantly rebalance CBDC markets.

- CBDC arbitrage ETFs or funds catering to institutions seeking exposure.

Over time, as CBDCs mature and settle into global FX systems, inefficiencies will narrow. But in the early years, AI traders who move fast will capture outsized opportunities.

💬 Frequently Asked Questions (FAQ)

What are CBDCs?

CBDCs are digital versions of fiat currencies, issued directly by central banks, combining the legitimacy of government money with the programmability of blockchain-like systems.

How can AI find arbitrage opportunities in CBDCs?

AI monitors global markets in real time, identifying spreads between CBDCs, stablecoins, and fiat, then executing trades in milliseconds.

Will CBDCs replace stablecoins?

Not immediately. Stablecoins will likely coexist with CBDCs, and spreads between them will fuel arbitrage opportunities.

Is CBDC arbitrage legal?

It depends on the jurisdiction. Some central banks may impose restrictions on trading CBDCs against crypto or foreign assets.

Which CBDCs offer the biggest arbitrage potential?

Early movers like China’s e-CNY and the Digital Euro will likely create the first inefficiencies due to limited liquidity and convertibility.

🖋 Final Thoughts

CBDCs represent both a challenge and an opportunity. They are programmable, state-backed money, but in their early rollouts they will create fragmented, illiquid markets ripe for arbitrage.

AI will be the defining edge in this space—able to spot, evaluate, and execute on CBDC spreads before human traders even notice.

In the emerging world of digital currencies, the question is not whether arbitrage will exist—it’s who will have the AI tools sharp enough to capture it.